Invoice Processing Definition

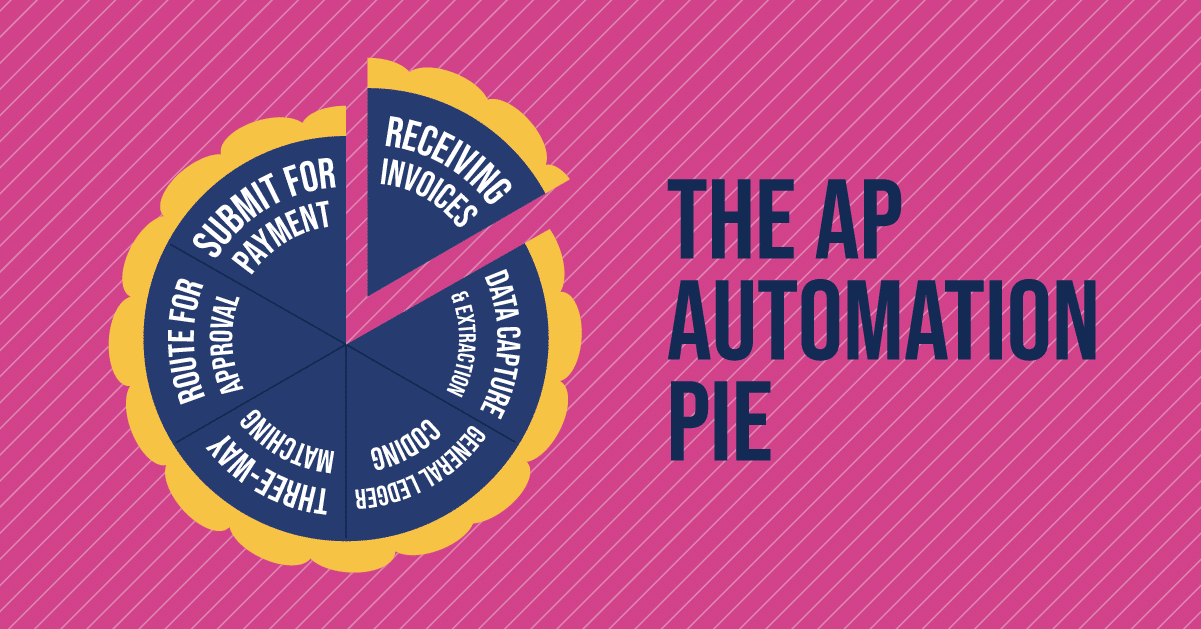

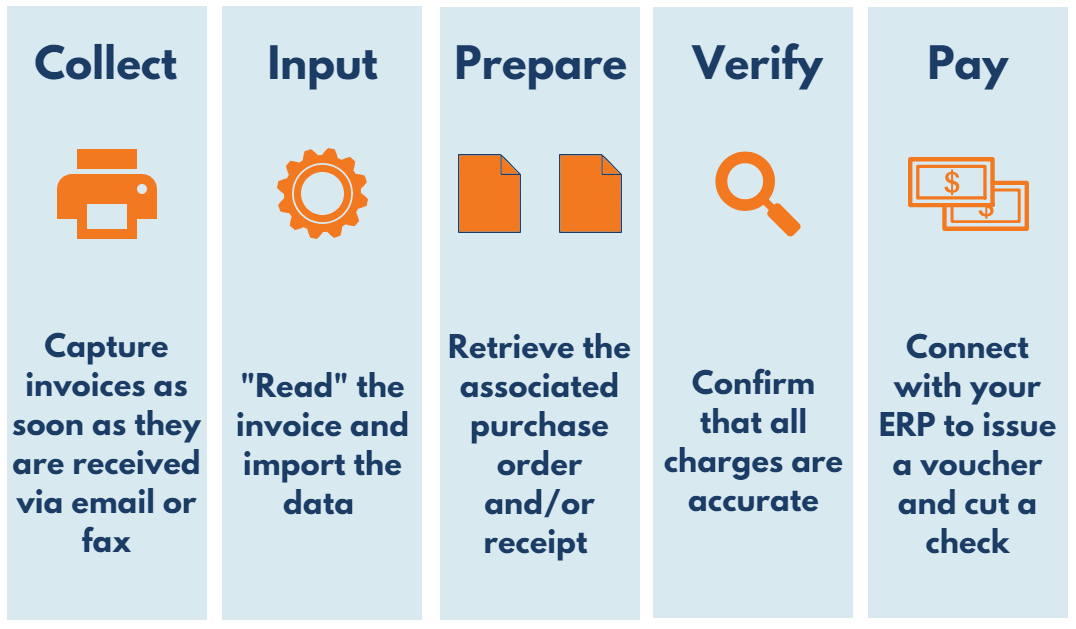

Invoice processing by definition is a business function performed by the accounts payable department which consists of a series of steps for managing vendor or supplier invoices from receipt to payment, and recorded in the general ledger. Invoice processing is often performed with software and it is commonly referred to as automated invoice processing or invoice automation for short. An invoice processing flowchart is a structured guide detailing the steps for how accounts payable is to process vendor invoices.

Here are the steps for invoice processing:

- Capture, general ledger (GL) code, and match supporting documents such as a purchase order and/or delivery receipt

- Send invoices to authorized approvers to approve or reject invoices

- Authorize and submit invoices for payment in a financial system

- Process invoices for payment via common payment methods such as check, ACH, or wire transfer

- Archive invoices and payment information in the GL and for audit purposes

The Benefits of Automated Invoice Processing

Automated invoice processing software is used by the accounts payable department to streamline invoice processes, add more control over internal processing functions with tracking functionality, and improve the speed at which vendor invoices are processed. Automated invoice processing software is akin to AP Automation. These automated invoice processing systems help accounts payable teams automate the capture, coding, and sending of invoice for approval in addition to automatically assigning approvers and pushing invoices into financial systems for payment.

Your Invoice Processing Software Guide

In this guide, we discuss how invoice processing automation tools are enabling Accounts Payable (AP) departments to keep their current workflows and how AP technology is streamlining their existing invoice processes. If you’re looking to streamline your Accounts Payable department and save time and money for both your organization and your AP team, here’s your detailed invoice processing guide:

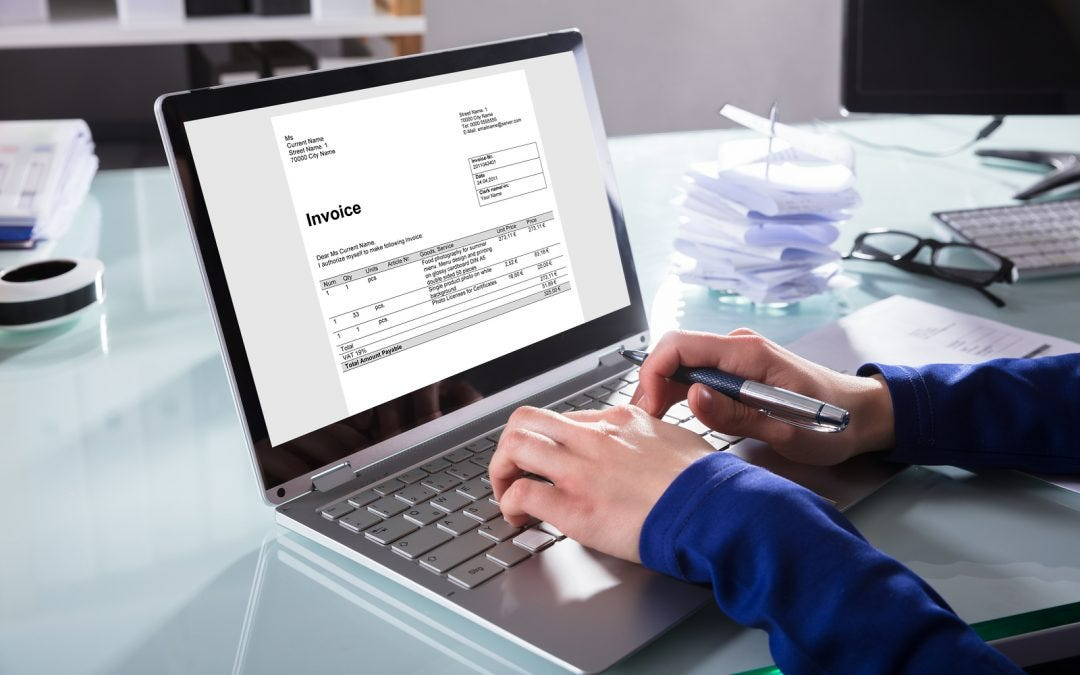

1. Paperless invoice processing

Manual invoice processes are typically paper-based, with AP teams sorting through and entering paper invoices by hand. Paper-based processing is slow and error-prone, and often leads to late or missed payments to suppliers.

Paperless invoice processing replaces these manual processes with automated workflows. It begins with converting paper invoices to digital formats and encouraging vendors to send digital invoices via email or a vendor portal. From there, the invoice processing software automatically scans the invoices, enters the invoice data into an accounting system or ERP, codes the invoice details, and matches the invoices to purchase orders. Once the invoices are entered and verified, the system forwards them for approval and payment.

“Since we are paperless we are not taking up any space in our filing cabinet.”

One Authority Billing customer says that after eliminating manual invoice processing with Authority Billing, they are “able to more accurately and timely record our AP expenses, and the approval process has saved us a lot of time. Coding invoices is so easy now compared to our old process of manually coding and hand-keying in our invoices…We dont have to touch so much paper. All invoices are emailed to Authority Billing and the software is able to read the invoice, amount etc. Invoices are getting out to additional users faster and approvals are getting done more quickly.”

2. Centralized data and processes

One of the drawbacks of manual invoice processing is that it makes it difficult for finance teams to access and use invoice data. Often, this data is buried in a spreadsheet or accounting system and can’t easily be accessed and analyzed. Even using a more advanced system like an ERP can be challenging. Many ERPs have complicated navigation, complex organizational structures and strictly controlled user roles that can make it almost impossible for AP teams to find useful information.

The beauty of paperless invoice processing (besides saving trees) is that it turns invoices into actionable data that AP teams can use to process invoices faster and more accurately. AP platforms like Authority Billing are easy to navigate and make it simple for AP teams to find the resources they need. One Authority Billing customer compares Authority Billing’s ease of use to SAP and Ariba, saying “[t]he interface is extremely easy to use. I much prefer this over Ariba and other SAP platforms…Authority Billing is solving the simplicity of what other SAP systems have yet to figure out. It is straightforward and it would be easy for anyone to pick up.”

3. Establishing and tracking KPIs

Another drawback of manual invoice processing is that it’s difficult for finance leaders to measure their AP teams’ performance, identify process bottlenecks, and track invoice processing metrics. Manually generating AP reports from spreadsheets is slow and doesn’t always provide actionable insights. Also, while many ERPs offer general reporting functionality, they don’t always provide the specific AP reports needed to monitor invoice processing performance. Often, AP teams are forced to create custom reports or find workarounds to get the information they need.

Invoice processing software platforms like Authority Billing automatically generate real-time AP reports and analytics and feature AP dashboards where users can check KPIs at a glance. Finance teams can use this data to make informed decisions about automation workflows, integration capabilities, and working capital management.

A cost accountant describes Authority Billing as a “well-designed product…[with] EXCELLENT reporting & drill-down capabilities.” Another user praises how Authority Billing’s reporting capability helps them maintain a complete audit trail: “My favorite thing about Authority Billing is how easy it is to use and how user-friendly the whole platform is. The reporting is fantastic, and the audit trail is even better. Out of all the automated AP systems I have used, this is by far my absolute favorite, and I recommend it all the time.”

4. Enabling collaboration

It’s hard for AP teams to collaborate with other business units and stakeholders when they are saddled with manual processes. Digging through emails, paper files, and voicemails is time-consuming and frustrating, especially for AP employees who are already working at capacity.

Many ERPs are structured in a way that AP teams can’t access the data, documents, or people they need to help them process invoices efficiently. One SAP ERP user describes the frustration they experience when trying to collaborate with team members: “Good software, rough user experience,” said one reviewer. “Finding the functionality you’re looking for, or the expense type you need, or adding a vendor, etc. just isn’t as easy as it should be. It’s also not readily apparent where you should go if you can’t find what you’re looking for.”

Best-in-class AP automation platforms like Authority Billing are designed for how AP teams work. They prioritize collaboration. For example, Authority Billing unifies all communications, documents, and tasks on top of each invoice so users can access the information they need and communicate with stakeholders and vendors from one screen.

A director of workforce management describes how Authority Billing has enabled collaboration at their organization: “Before using Authority Billing, the invoice management process in place lacked collaboration between all parties involved in reviewing and approving just 1 invoice. In my company, we have tens of invoices that come through a day, so it is extremely important to have a system in place that works for all levels from field staff all the way up to CFO.

Authority Billing has provided structure, ease & teamwork since day 1!”

Leave a Reply