Forward-thinking wealth managers recognize that the right technology doesn’t just streamline operations—it fundamentally transforms how they cultivate trust, deliver value, and build their practices.

This article explores the dynamic relationship between emerging wealth management tech and exceptional client service, creating boundless opportunities for deeper client engagement and scalable growth across the wealth management industry.

Key takeaways

Modern wealth management technology enhances rather than replaces personal relationships, creating more time for meaningful client interaction while improving service quality.

Integrated platforms that connect operations, reporting, and client communication naturally build trust through increased transparency and responsiveness.

The right technology creates a foundation for scalable growth by automating routine tasks while maintaining high standards of security and compliance.

What is wealth management technology?

What is wealth management technology?

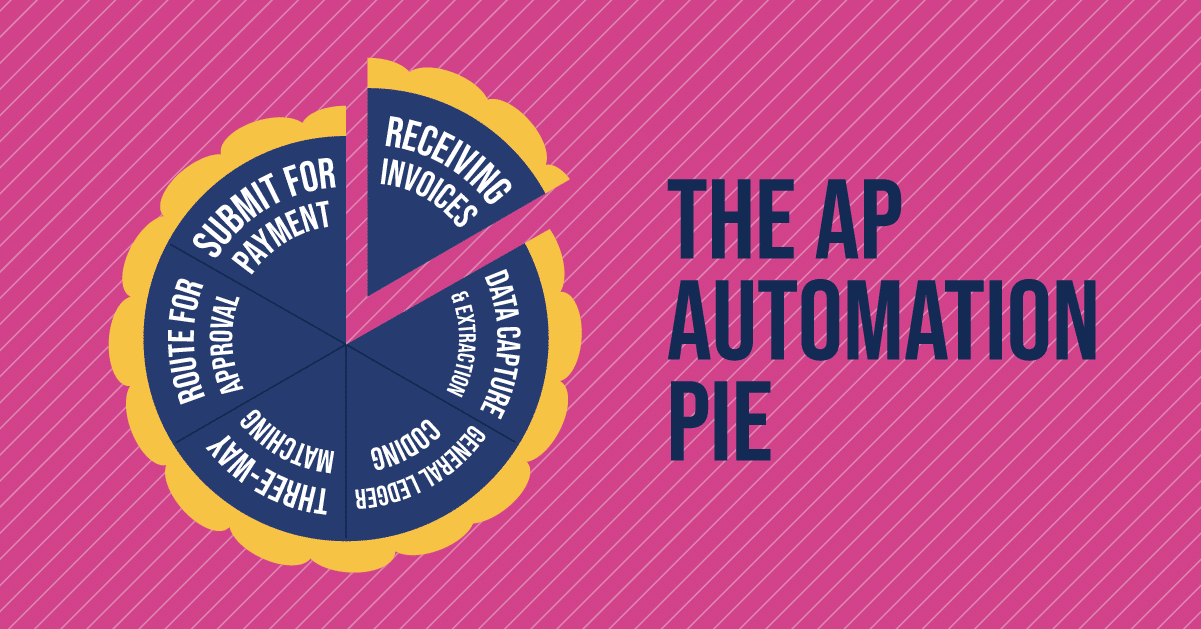

Wealth management technology has evolved far beyond simple digital tools into sophisticated platforms that integrate every aspect of client service and practice operations. These comprehensive wealth management solutions create natural workflows that enhance both efficiency and effectiveness, connecting everything from client communication and reporting to compliance and strategic planning.

Modern platforms recognize that different elements of wealth management organically influence and reinforce each other. By integrating these elements thoughtfully, they help create the conditions for operational excellence, fueling deeper client relationships and natural paths to growth.

How technology integrates with traditional wealth management

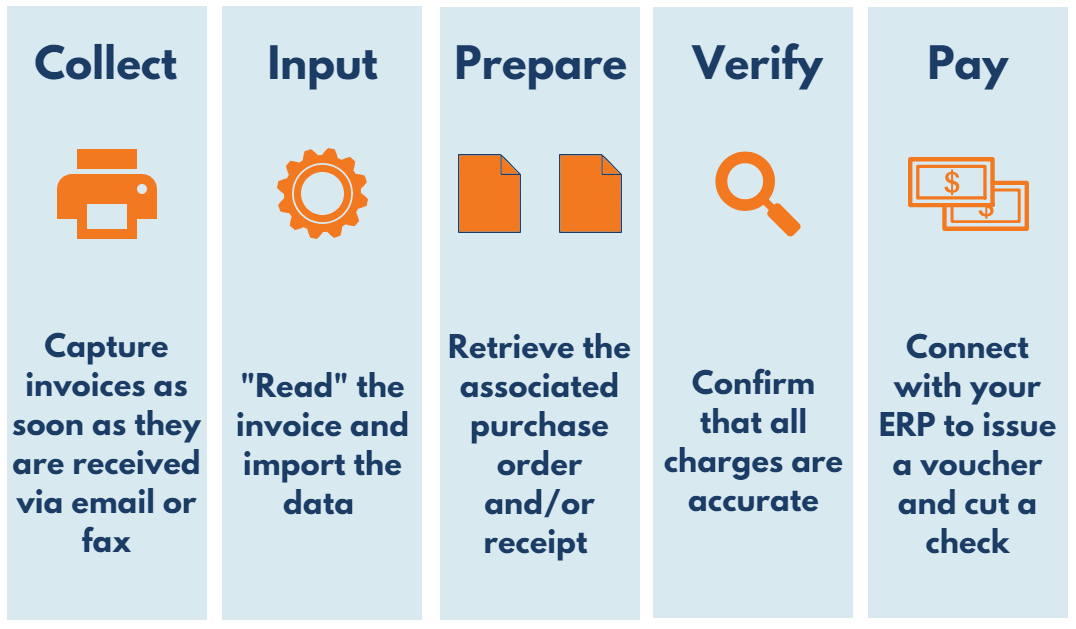

Rather than replacing personal expertise, today’s wealth management technology amplifies it. The most successful implementations recognize that technology works best when it enhances rather than disrupts the human elements of wealth management. When routine tasks are automated effectively, wealth management firms can focus more attention on the strategic guidance and personal interaction that truly drive client success.

This complementary relationship between technology and expertise creates a virtuous cycle. As technology handles more routine operations efficiently, financial planning advisors can dedicate more time to meaningful client interaction and strategic planning. This deeper engagement naturally builds trust, which in turn creates opportunities for broader wealth management services and sustainable growth.

Benefits of leveraging wealth management technology

The thoughtful implementation of wealth management technology delivers benefits from enhanced client experience to improved operational efficiency. These advantages work together to drive practice success while deepening client relationships.

Enhanced client experience and engagement

Modern technology creates multiple channels for meaningful client interaction while ensuring consistent, high-quality service delivery. Secure client portals provide 24/7 access to important information, while automated reporting ensures regular updates that keep clients informed and engaged. Mobile apps let clients upload documents easily and check their finances from anywhere, creating convenience that naturally enhances satisfaction.

Most importantly, these tools support rather than replace personal interaction. By handling routine tasks efficiently, they create more time for the strategic discussions and relationship building that fuel client success and increase referrals.

Operational efficiency and scalability

Automation and streamlined workflows dramatically reduce the time spent on administrative tasks, creating capacity for higher-value activities. Rather than wrestling with manual processes, wealth management teams can focus on strategic planning and proactive client service, driving practice growth.

This efficiency naturally supports scalability. As routine tasks become more automated, practices can take on additional clients while maintaining service quality. The result is sustainable growth that enhances personal attention and strategic focus.

Improved data accuracy and insights

Modern platforms streamline data management while providing powerful analytics that support strategic decision-making. Real-time visibility helps advisors spot opportunities and potential issues early, enabling more proactive responses.

This improved accuracy and insight naturally builds trust. When clients can see their financial position clearly and understand how different factors influence their success, they’re better positioned to engage meaningfully in strategic planning and long-term wealth management.

Strengthened security and compliance

Today’s wealth management technology addresses critical security concerns while simplifying regulatory compliance. Advanced encryption, multi-factor authentication, and detailed audit trails protect sensitive information while maintaining accessibility for authorized users. Automated compliance checks help catch potential errors or fraud before they happen, increasing client trust in these internal processes and their ability to keep client data safe.

This enhanced security naturally supports client confidence. When clients know their sensitive information is protected by robust systems and controls, they’re more likely to engage fully with digital tools and share the information needed for comprehensive wealth management.

Competitive advantage in client acquisition and retention

Technology-enabled capabilities create clear differentiation in a competitive marketplace. The ability to provide faster responses, deeper analysis, and more strategic consultation increases both client acquisition and retention. This advantage becomes self-reinforcing as satisfied clients provide referrals that drive organic growth.

Moreover, these capabilities help wealth managers demonstrate measurable value. When clients can see how technology enhances their experience while supporting more strategic guidance, they’re more likely to recognize and appreciate the comprehensive value their wealth manager provides.

Leave a Reply